Hello! As we settle into 2021, we hope this letter finds you well.

While last year brought the pandemic, it also brought record-low mortgage rates and a surge of buyers looking for homes better suited for remote working, virtual learning, and in-home recreating. Meanwhile, home prices pushed upward and buyer demand surged.

In this mailing, we have put together a mosaic of predictions from industry experts about what we can expect from mortgage rates and the real estate market in 2021. Give us a call 630-313-4560 after reading through the predictions, and we can talk about this email or the opportunities you may have this year to refinance or buy a home.

From the National Association of REALTORS®

Home sales in 2021 are expected to rise by around 10%. Home prices will also climb but will be more moderate increases than what we’ve seen, a break for first-time buyers. Mortgage rates will continue to be favorable, staying at or near historic lows of 3% on average. The labor market will strengthen, especially as vaccines become widely available.

From Realtor.com

The largest generation in history, millennials will continue to shape the housing market as they become an even larger player. The oldest millennials will turn 40 in 2021 while the younger end of the generation will turn 25. Older millennials will be trade-up buyers with many having owned their first homes long enough to see substantial equity gains, while the larger, younger segment of the generation age into key years for first-time home buying. At the same time, Gen Z buyers, who are 24 and younger in 2021, will continue their early foray into the housing market.

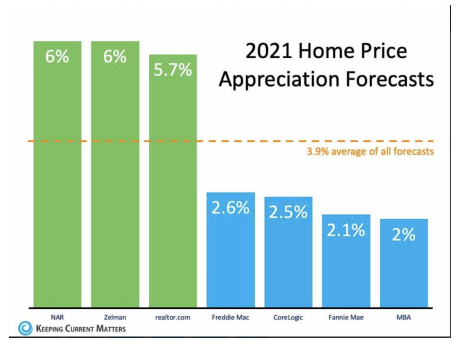

From Keeping Current Matters Real Estate Advisors

Low mortgage rates have driven buyer demand over the last twelve months. According to Freddie Mac, rates stood at 3.72% at the beginning of 2020. We’re starting 2021 with rates one full percentage point lower than that. Low rates create a great opportunity for homebuyers, which is one reason why demand is expected to remain high throughout the new year. Taking into consideration these projections on housing supply and demand, real estate analysts forecast homes will continue to appreciate in 2021, but that appreciation may be at a steadier pace than last year. Here are their forecasts:

From the National Association of Home Builders

For 2021, NAHB expects ongoing growth for single-family construction. It will be the first year for which total single-family construction will exceed 1 million starts since the Great Recession, a 2.5 percent gain over the final 2020 total of 884,000. Starts will be up more than sales in percentage terms because builders need to catch up with the sales undertaken in 2020. Growth is expected because the inventory of both new and existing homes remains low. There is only 4.1 months’ supply of new homes available, with five to six months considered balanced.

From Zillow Online Home Sales

A perfect storm of market conditions will create the hottest spring shopping season in recent memory, with sales happening quickly and often above list price. Many prospective homeowners will become more certain about whether their jobs will be performed remotely long term, which could add buyers to the market who had been waiting for that question to be settled. Rising mortgage rates could also add to the buyer frenzy. Although dense, urban living got a bad rap this year because of the pandemic, city living will almost certainly enjoy a renaissance in 2021.

From Redfin Online Real Estate Brokerage

More new homes will be built next year than in any year since 2006. In 2021, the landscape for home builders will be even more favorable. Rising prices for existing homes will increasingly drive more buyers to consider a new one. And because home buyers are now more eager to buy in suburban and rural areas where land is cheaper than in the cities, there will be more areas where homes can be built profitably.

From Mortgage Bankers Association

Mortgage rates will average 3.3 percent in 2021. If the rate picture follows this path, the refinancing boom of 2020 will slow dramatically by the second half of 2021 as the economy really finds its footing. While mortgage rates will rise enough to discourage refinancing, they’ll remain low enough to make home-buying attractive.

From Bankrate.com

It will be an especially volatile year for mortgage rates, with fixed rates falling to even lower lows early in 2021 on economic concerns but rebounding in the back half of the year as widespread vaccinations lead to a surprisingly strong surge of economic activity — and inflation worries that come with it. The year will end with rates of 3.1 percent.

Don’t hesitate to give us a call to ask questions or get advice or to just catch up since we last spoke. We hope to hear from you soon.

If you have friends or neighbors who are looking to refinance or buy a home, we would appreciate you passing along our name.

Thank you and be well.