Are you aware that in the middle of the pandemic the real estate market is thriving? Our real estate agent friends are working 24/7 to show homes and manage sales and we’ve been financing homes for our friends and neighbors at a record pace.

At the moment, buyers are certainly capitalizing on record low interest rates and searching for homes that better fit their lifestyle in a pandemic world. The good news is that this active real estate market has all the signs of continuing to remain “hot.”

Here is what Mark Fleming, Chief Economist for First American, recently reported:

“Since hitting a low point during the initial stages of the pandemic, the only major industry to display immunity to the economic impacts of the coronavirus is the housing market. Housing has experienced a strong V-shaped recovery and is now exceeding pre-pandemic levels.”

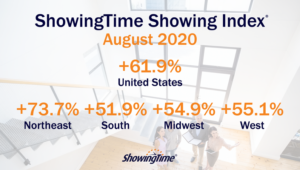

Furthermore ShowingTime, which tracks the average number of buyer showings on residential properties announced that “buyer showings are up 61.9% compared to the same time last year” and real estate activity that normally begins to slow down in the late summer has peaked well into the fall.

The Quarterly Forecast of the Federal Home Loan Mortgage Corporation, better known as Freddie Mac, shows that the housing market will continue to rebound as mortgage rates hover near record lows:

Here are highlights from the forecast released in mid-October:

- The average 30-year fixed-rate mortgage is expected to be 3.2% while staying near historically low levels in 2021.

- House price growth is expected to increase to an annual rate of 5.5% in 2020.

- Home sales are expected to remain nearly the same or unchanged in 2021.

- Purchase originations are expected to total $1.4 trillion and remain near that level in 2021.

The Cloud on the Horizon

There is a cloud covering this fluctuating but optimistic outlook for the real estate market. Purchaser demand is so high, the market is running out of available homes for sale, and this lack of supply naturally drives up the price of homes creating a seller’s market.

Here’s what a realtor.com analyst said in September:

“Since the beginning of the COVID pandemic in March, nearly 400,000 fewer homes have been listed compared to last year, leaving a gaping hole in the U.S. housing inventory.”

What Does This Current Market Mean for Sellers?

Anyone thinking of putting their home on the market should not wait. A seller will always negotiate the best deal when demand is high and supply is limited. That’s exactly the situation in the real estate market today.

Keeping Current Matters, a source of market news for realtors, reported:

“Next year, when the pandemic is hopefully behind us, there will be many more properties coming to the market. Don’t wait for that increase in competition in your neighborhood. Now is the time to sell.”

At the moment, we have a seller’s market, with low inventory and high buyer competition, and you can expect to quickly sell your home if you price it right. You might worry, however, about closing on the sale before you have found your new home. Visions of moving into temporary housing – a lease-to-lease apartment rental, your friend’s couch, or your in-laws basement – flash before your eyes.

Here’s the bottom line for sellers: Don’t let concerns of being “homeless” keep you from taking advantage of current interest rates and the present seller’s market. Select an experienced real estate agent who understands how to coordinate the sale of your old home with the purchase of a new home. Choose an independent lender, like Two Roads Lending, who understands the local real estate market and who knows how to navigate the loan process to ensure a timely closing. If you are ready to put your house on the market (or are even considering selling your home), let’s have a conversation about your options!

What Does This Current Market Mean for Buyers?

The right time to buy a home is different for everyone. There are personal factors to consider and factors related to the market. Buyers this fall/winter will be thrown into a seller’s market, where demand exceeds supply and seller’s are commanding top dollar. You could wait until next spring to buy a home, hoping for increased inventory, but there is no guarantee interest rate won’t trend upward in 2021. There is always uncertainty in the real estate market.

The bottom line for buyers: If you are considering buying a new home in 2020 or 2021, have a conversation with us. We will help you get a sense of how close you are to being ready for homeownership. And, we’ll help you figure out whether buying the home in the near future is a smart move for you or whether you might be better off waiting. Either way, we would be honored to guide you on the path to homeownership, and we will work hard to offer you a lending solution that is unique to your needs.

What Does This Current Market Mean for Renters?

If you want to stop renting and become a homeowner, now may be the right time. Rent, which fluctuated very little from 2003 to 2015, has steadily increased over the past five years. RentCafe.com, a nationwide apartment listing service, predicts that rents are likely to maintain an upward streak throughout 2020 and into 2021.

Whitney Airgood-Obrycki, a research associate with the Harvard Joint Center for Housing Studies summed up the situation in one short sentence:

“Ultimately, the country is in a rental affordability crisis.”

The good news for renters is that historical low mortgage interest rates are making owning a home more affordable than ever. Renters are finding that they can buy a two to four bedroom home (depending on location) with a monthly mortgage payment that is about the same as their monthly rent.

The bottom line for renters: If you are currently renting, you owe it to yourself to talk to us about your potential to become a homeowner. And if together we reach the conclusion that buying a home is not your best option at the moment, we will help you get on the path to eventual homeownership.

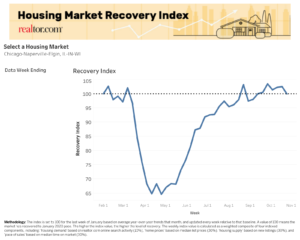

The “Recovery Index” Indicates the Housing Market is Back to Its Pre-Covid Pace

Despite the cooler weather, the housing market continues to remain hot nationally and locally. The graph below from Realtor.com highlights the Chicagoland housing market recovery index, ending the week of October 24, 2020. A value of 100 means the market has recovered to January 2020 pace.*

*How to read the index – the overall index is set to 100 for the last week of January based on average year-over-year trends that month, and updated every week relative to that baseline. A value of 100 means the market has recovered to January 2020 pace. The higher the index value, the higher the level of recovery. The lower the index value, the lower the level of recovery.

Start a Conversation

We are seeing buyers and sellers remain motivated in spite of the pandemic, and we are encouraged that market analysts are predicting that the real estate market recovery will continue through the end of the year.

We are here to help you as you consider where you fit in this thriving real estate market. Let’s have a conversation.